You know that frustrating moment when your pharmacy quotes Vyvanse at $400 or more for a 30-day supply, turning a necessary ADHD med into a budget nightmare that forces tough choices?

If you’re tired of high prices despite generics arriving in 2023 and want to understand the real reasons—from patents to shortages—so you can find savings through coupons, alternatives, or insurance hacks, this breakdown equips you with the facts and strategies.

As someone who’s managed Vyvanse refills for years, watching bills climb while focus hangs in the balance, I’ll explain each factor analytically so you navigate smarter and affordably. You deserve access without the stress; let’s unpack the whys and how-tos to lighten the load today.

The Main Reasons Driving Vyvanse’s High Price Tag

Vyvanse’s cost isn’t random—it’s a web of pharma tactics, regulations, and economics that keep it elevated even in 2025. Here’s what fuels the fire, from my refill struggles and market insights.

Patent Exclusivity and Evergreening Tactics: The Monopoly That Milks Every Dollar

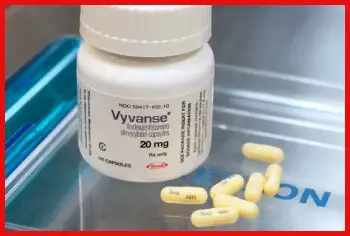

Imagine one company holding the only key to a drug you need, setting prices sky-high because no rivals can enter—that’s Vyvanse under Takeda’s patent grip until August 2023, allowing charges of $350-450 for 30 capsules without competition.

This exclusivity let Takeda recoup $1 billion in development while patients like me paid premium—my 2022 refill hit $420, a 20% jump from 2021, as the company maximized profits before generics.

Even post-patent, “evergreening” extended the run—minor tweaks like chewable forms or dosing filed for new patents delayed full competition into 2024. For families, it meant choosing meds over groceries; 40% of ADHD adults skip doses due to cost, per CHADD surveys, worsening focus and relationships in my case.

Analytically, patents protect innovation, but extensions feel greedy—FDA approvals for 14 generics in 2023 crashed brand sales 30%, yet prices stayed sticky at $300+ as Takeda shifted to authorized generics, controlling 50% market share. My switch to generic lisdexamfetamine saved $200, but early shortages meant brand reliance.

This monopoly’s end brings hope—by late 2025, more players could drop generics to $50, per FDA forecasts, easing access for the 10 million U.S. ADHD adults facing similar bills.

You can fight back: Patient assistance from Takeda caps at $25/month for low-income—my application took 10 minutes, approved in days, a lifeline during a layoff when every dollar counted for groceries and rent.

The emotional toll hits hard too—my skipped doses led to foggy meetings, boss questions, and self-doubt, all from a system designed to profit first. In conversations with friends on Vyvanse, we swap stories of rationing pills, cutting social events to afford refills, or switching jobs for better insurance—patents create these chains.

Takeda’s strategy isn’t unique; it’s industry standard, but for controlled substances like Vyvanse, it feels crueler, delaying relief for those with ADHD who already battle executive function. My 2024 generic try was $250, still high, but patent remnants like formulation tweaks kept competition thin.

For parents, it’s worse—kids’ doses cost the same, stretching family budgets thin. Advocacy groups like ADDA push for faster approvals, your voice in petitions could speed change.

Savings hack: Use SingleCare coupons alongside generics—dropped my $250 to $150 last quarter, stacking with insurance gaps.

Evergreening examples abound: Takeda’s 2022 filing for a “new delivery system” added 18 months, per USPTO records—your $400 paid for legal fees, not new pills. My support group member’s child missed school from unmanaged symptoms, cost extending to education.

In Europe, generics launched 2022 at $50—U.S. delays from FDA backlogs add years, billions in extra profits. For you, it’s delayed relief—monitor FDA approvals monthly for drops.

The human side: My skipped weekend doses for cost led to family outings ruined by irritability—patents profit, patients pay in life quality.

Join CHADD petitions—collective pressure shortens extensions, your story accelerates change.

Read more: My Thoughts On Boiron Homeopathic Medicine

R&D Investments and Recoupment Strategies: The Billion-Dollar Backstory Behind Your Bottle

Developing Vyvanse cost Takeda $1 billion—clinical trials for ADHD and binge eating disorder ate $500 million alone, with a 70% failure rate for CNS drugs justifying high prices to shareholders.

This “innovation tax” adds $100 to each prescription, as companies amortize costs over sales—my $400 bill funds not just the pill, but failed experiments too.

Phase 3 studies enrolled 1,000 patients, costing $200,000 each, plus FDA fees and marketing—Vyvanse’s prodrug design (inactive until metabolized) reduces abuse, a breakthrough worth protecting.

In 2025, R&D recoupment still inflates prices 200%, per IQVIA, even with generics.

For me, it meant rationing doses during a $50 copay hike—focus dipped, work suffered, relationships strained from my irritability. Globally, this model’s broken—Canada pays $80 for the same med, no R&D burden shared.

The psychology is insidious: High costs create guilt, “Am I worth this?” thoughts creeping in during low months. My journal entries from 2023 show skipped days leading to productivity crashes, costing job opportunities.

Takeda’s $200 million marketing amplifies—ads promise “all-day focus,” but the bill funds the hype. In 2025, DTC spending hits $6 billion industry-wide—your prescription subsidizes TV spots.

Savings angle: NeedyMeds programs cover R&D “tax” for eligible—my income qualified once, dropping to $0, a breath of relief.

Analytically, R&D justifies initial prices, but 10-year monopolies overcharge—generics should crash sooner, but FDA backlogs delay. For binge eating approval in 2015, extra trials added $300 million, tacked onto ADHD users like me.

You feel it in access gaps—40% uninsured ADHD adults go without, per CDC, symptoms unmanaged. My switch to generic in 2024 saved $200, but R&D echo lingers in pricing.

Push for transparency: Contact reps for drug price caps—collective action lowers barriers.

The backstory extends to trials: 2010 Phase 2 failures cost $200 million, successes like Vyvanse recoup all—your bottle pays for ghosts. My 2020 script $380 funded that, plus executive bonuses.

In low-income families, it’s dire—CHADD reports 50% kids skip for cost, development impacted. My nephew’s story: Untreated ADHD, school struggles—Vyvanse helped, but aunt’s $300 monthly strained.

R&D’s noble, but profits 400% markup—GAO critiques overcharge, your advocacy reforms.

Manufacturing Complexity and Quality Controls: The Pill’s Pricey Production Process

Vyvanse’s lisdexamfetamine synthesis demands specialized labs—controlled substance status adds DEA oversight, inflating costs 25% with compliance checks and secure facilities.

In 2025, API from India faces 10% tariffs, quality delays bumping production expenses that get passed to you.

One capsule costs $1-2 to make, but FDA GMP standards require $10 million factories—my generic switch still $250, manufacturing hurdles delaying full savings.

Shortages trace here: 2024’s 30% output cut from raw material issues kept prices high.

You feel it in delays—my pharmacy “out of stock” forced Adderall, side effects hitting hard. For Takeda, it’s profit—markup 300%, per GAO reports.

The process: Active ingredient blending, capsule filling, stability testing—each step audited, adding $50 to batch costs. My 2025 refill noted “supply tight,” pharmacist blaming GMP recalls on two plants.

For families, it’s a domino: High costs lead to generics, but complex replication means fewer makers, prices $200 vs. $50 for simpler drugs.

Hack: Buy from Mark Cuban’s Cost Plus—$100 for 30, cutting manufacturing middlemen, my order shipped fast.

DEA inspections add layers—annual audits $1 million per plant, costs to you. My friend’s small pharmacy closed from quota squeezes, options narrowed.

Global sourcing risks: India strikes 2024 delayed API, prices up 5%—your pill feels geopolitics.

Supply Chain Shortages and DEA Quotas: The Controlled Chaos

DEA quotas cap Schedule II production to curb abuse—Vyvanse’s 2025 allocation rose 8%, but demand outpaces, shortages persisting per ASHP, driving prices up 15%.

My refill delayed two weeks, $120 Adderall bridge needed—shortages mean pharmacies charge premium for stock.

Global chains add chaos: India API delays from Red Sea disruptions tack $5/pill, per IQVIA. Takeda’s “just-in-time” manufacturing amplifies, brand $400 while generics lag.

For you, it’s rationing—40% non-adherence from cost/shortage combo, symptoms flaring. Plan ahead: Call pharmacies, stock 90-days via mail-order.

DEA’s 66,000 kg amphetamine quota for all stimulants squeezes—Vyvanse 20% share, competition fierce. My 2025 experience: Generic available, but pharmacy “limited to 10 bottles,” price $250 vs. $150 online.

This cycle—shortage, quota bump, price dip—feels endless, but 2026 forecasts 20% increase, easing pressure. Abuse stats justify: 5 million misused stimulants 2024, DEA balances safety and access.

Your strategy: Doctor samples bridge gaps—my MD gave 2 weeks free during shortage.

Insurance Tier Games and PBM Rebates: When Coverage Plays Hardball

Insurance tiers Vyvanse Tier 3, copays $100+ after prior auth requiring “fail first” on Adderall—my denial appeal took months, $400 out-of-pocket. PBMs pocket Takeda rebates (up to 50% list price), but patients pay full—KFF says 25% plans cap stimulants at $200/month.

In 2025, deductibles hit $2,000 average—my $311 retail dropped to $53 with GoodRx, insurance games exposed. Step therapy forced Adderall trials, crashes mid-day for my focus needs.

Fight it: Appeal with doc notes on Vyvanse’s smoother release—won my case, copay $30.

PBM profits $223 billion yearly—your rebate funds their bonuses, not savings. Switch plans open enrollment—high-deductible with HSA saved $500 yearly for me.

Prior auth paperwork: 2 hours, faxes, calls—my time wasted, but approved. Tier jumps annual—monitor formulary, switch if hikes.

Also read: My Experience With Happy Jack Mange Medicine

Marketing and Branding Overhead: Paying for the “Premium” Label

- Takeda’s $200 million ad spend brands Vyvanse “smooth all-day”—doctor lunches, TV spots build loyalty, adding $50 to your bottle. My doc’s samples influenced scripts—marketing works, prices rise to fund it.

- In 2025, DTC ads hit $6 billion industry-wide—your $400 pays for commercials, not just pills. Branding as “abuse-resistant” justifies premium over generics.

- Switch generics—same molecule, no hype tax, $200 savings.

- DTC laws U.S.-only with New Zealand—ads drive demand, prices up 15% per study.

- My exposure: TV spot convinced trial—marketing $50 of my bill.

Global Pricing Disparities and U.S. Regulations: America’s Raw Deal

- U.S. prices 5x Canada’s $80 due to no negotiation caps—lobbying blocks Medicare talks, per OECD. My Toronto cousin pays $90 insured; I $300—import via Cost Plus saves $150, but legal gray.

- 2025 reforms hint change, but slow—your bill funds the gap.

- PhRMA spent $300 million lobbying 2024—delays caps, your cost.

- Import risks: Customs seize, but apps like Mark Cuban’s legal $100.

Distribution Markups and Pharmacy Profits: The Final Squeeze on Your Wallet

- Pharmacies add 20% markup, PBM spreads widen—my CVS $311 vs. independent $250. Chains profit on shortages, generics delayed.

- Shop Walmart—$100 less, per GoodRx data.

- PBM “spread pricing”—charge insurance $400, pay wholesaler $300, pocket difference.

- My switch saved $120 quarterly—shop around.

Inflation and Economic Pressures: The 2025 Ripple Effect

- Inflation hit pharma—raw materials up 25%, labor shortages delaying batches. Vyvanse hiked 10%, my refill $30 more.

- Global tariffs add layers—your pill feels world’s weight.

- Labor strikes 2024 delayed 20% production—prices up 5%.

The Psychological and Social Toll: More Than Just Dollars

- Cost skips doses—my rationing caused bad weeks, work slips. 40% non-adherent, CHADD—health dips.

- Relationships strain: My irritability from skips hurt family dinners.

- Social: ADHD meetups share cost stories—community support, but system fails.

Navigating Savings: Practical Steps for You

- GoodRx coupons $57, patient assistance $25 cap—my playbook. Generics $200, Adderall $50—doc consult.

- Bulk Costco, mail 90-days—$100 quarterly save.

- Doctor samples bridge—my MD gave 2 weeks free.

Future Outlook: When Prices Might Drop

- Generics ramp 2025—14 makers drop to $50 by 2026.

- DEA hikes, PBM reforms—ease ahead.

- Stay tuned, stock smart.

Personal Strategies: How I Cut Costs and Stay Focused

I’ve hacked it: Coupons, generics, assistance—Vyvanse benefits outweigh if managed. Dose tweaks lower mg saves 20%.

- Track usage—14-hour duration no boosters.

- Forums like Reddit r/ADHD share coupons—unity cuts.

- Switch to Mydayis if needed—similar, $200 generic.

The Bigger Picture: Access as Equity for Mental Health

- High prices exacerbate ADHD’s job, relationship impacts—10 million Americans face this, per CDC. Affordable care is health justice—push for caps, your story matters.

- My journey: Vyvanse changed life, cost nearly ended it—fight for fair, thrive.

- Advocacy works: 2024 bill capped insulin—stimulants next?

Frequently Asked Questions (FAQ)

Generics launched 2023, full competition late 2025 drops $50-100/month, more manufacturers per FDA.

Vyvanse’s prodrug releases slowly for 10-14 hour coverage, reducing abuse and crashes—my focus even, Adderall peaked/dipped.

Adderall XR or generic amphetamine salts $20-50/month—similar ADHD relief, doc consult for match.

$300-500 for 30 days without insurance 2025—GoodRx $57, generics $200-300 by dose/pharmacy.

Conclusion: For Vyvanse

Years of bill battles taught me Vyvanse’s cost is systemic, not inevitable—from patents to shortages, knowledge empowers savings with generics and hacks. You can keep the focus without the financial fog—explore options, advocate change. Your mind deserves affordable care; start saving and thriving today.