As a prospective renter, you ought to anticipate a property owner to evaluate you before authorizing the lease. Issues that the landlord possibly intends to resolve consist of whether you are likely to take proper care of the residential or commercial property, whether you pay lease on time, whether you unreasonably complained to previous property owners, and whether you created troubles with your previous other lessees or next-door neighbors. If you have a pet dog, for example, the landlord will certainly intend to verify that you recognize exactly how to control it so that it does not disrupt others.

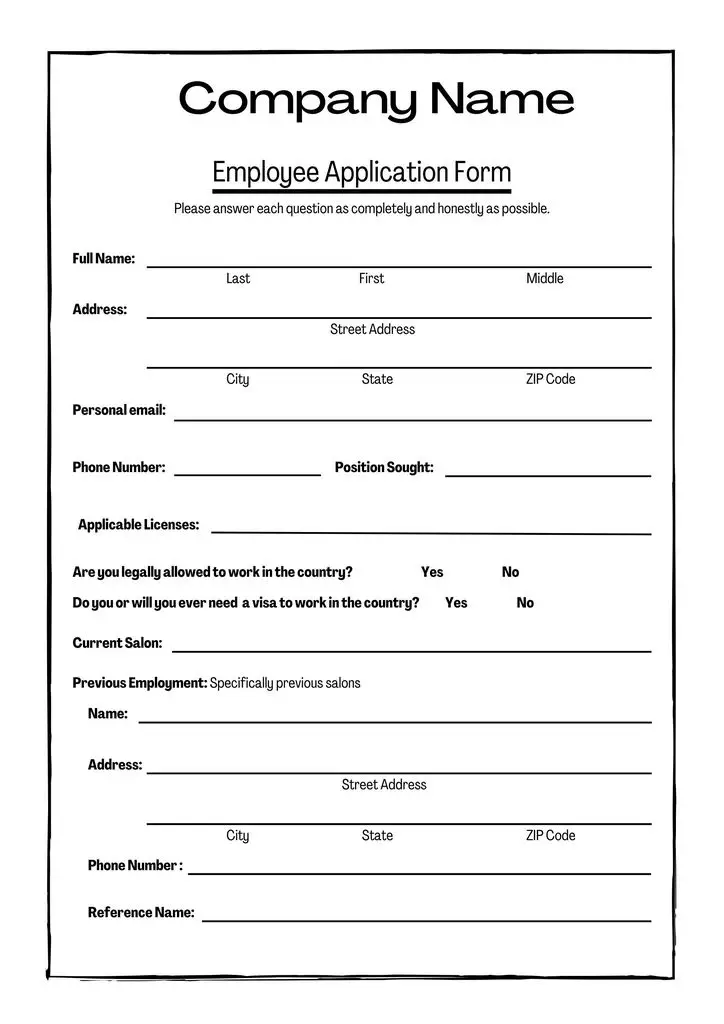

Info Covered on a Rental Application

Some of the common problems attended to on rental applications consist of a potential renter’s criminal background, credit history, and any kind of previous expulsions by previous landlords. Landlords may inquire about the nature of your work and income sources, and individuals who are freelance may be a lot more very carefully vetted.you can find more here More details about new york lease application from Our Articles While property managers can not discriminate on the basis of immigration standing, they can request evidence of a foreign national’s legal standing in the U.S. They can likewise request determining info like a Social Security number or driver’s permit.

Sometimes, a prospective renter might select to meet a proprietor with a completed rental application currently in hand, along with their credit score record and referrals from prior property owners and others. This is not needed yet can be a way to begin the relationship on a solid footing.

A property owner might desire even more details regarding a prospective tenant’s animal. It may be a great concept to gather favorable referrals from previous landlords or next-door neighbors and any other proof of good behavior, such as obedience or training certifications.

Background and Referral Checks

Rather than taking the info on the application at stated value, landlords will normally follow up by checking it with a potential renter’s property managers. They also may ask an employer or a credit scores reporting company to confirm information related to income and credit history. Landlords have to receive a finished authorization kind from a renter to do this, yet providing this permission is typical.

Tenants do have legal rights during this procedure. Landlords might not make use of the history check procedure to assist the discriminate against certain teams whom they do not want on their building, such as groups defined by race, faith, or nationwide origin. They additionally are not enabled to ask irrelevant concerns that get into a potential renter’s privacy. The authorization form must be worded in such a way that safeguards the legal rights of renters by restricting the extent of the details readily available to the property manager.

If you had an aggressive partnership with your present proprietor or a prior property owner, you may wish to present your side of the story before they offer their own. You could be able to supply a potential proprietor with cops records talking about safety and security concerns if this was a variable, or there could be public records showing code offenses by the present or prior property owner, for example.

Third parties whom the proprietor get in touches with are not required to connect with the property owner, even if the lessee has actually finished the authorization form and even if the tenant asks them to give info.

Inspecting Credit History Information

Landlords often will intend to explore a prospective renter’s credit report. They can figure out if you have been late in paying your rental fee, evicted, convicted, or otherwise involved in litigation at any moment in the last 7 years. Likewise, they can discover whether you have declared insolvency in the last one decade. Possible renters might need to pay a small fee to cover the cost of the check. They may also intend to perform a look at their very own in advance to ensure that they can deal with any problems or prepare an explanation for them.

The government Fair Credit report Coverage Act provides you the right to find out the identification of a credit report coverage agency that reported adverse info about you if this resulted in a property manager rejecting you or billing greater lease. You have a right to get a free duplicate of your data from the agency, but you have to request it within 60 days of the property owner rejecting you. You can dispute the accuracy of the details in the record, although the property owner will certainly inform you that the company did not decide not to lease to you and is exempt for describing why you were declined.