In today’s complex and fast-paced business environment, financial controls and reconciliation are more important than ever. Errors and inefficiencies in record-to-report processes can lead to incorrect financial data, delayed closings, and compliance issues.

That’s why many companies are turning to financial automation solutions like BlackLine and Trintech.But with different features and capabilities, how do you know which one is right for your organization?

This comprehensive guide examines BlackLine and Trintech side-by-side, providing an in-depth look at their pros, cons, and key differentiators.

A Brief Comparison Table:

| Feature | BlackLine | Trintech |

| Focus | Financial close management | Record-to-report process optimization |

| Reconciliation Capabilities | Comprehensive account reconciliation | Balance sheet reconciliation |

| Transaction Matching | Rules-based engine | Machine learning algorithms |

| Task Management | Robust configurable workflows | More basic capabilities |

| Reporting & Analytics | Customizable dashboards and reports | Embedded analytics and role-based reporting |

| Automation | Limited capabilities | Extensive RPA and workflows |

| ERP Integrations | Pre-built connectors for most major ERPs | Less extensive integrations |

| Compliance | SOC 1 Type 2 and SOC 2 Type 2 compliant | SOC 2 Type 2 compliant |

| Customization | Highly customizable | Custom workflows but less flexibility |

| Ease of Use | Steep learning curve | Very complex implementation |

| Total Cost | Can be high over time | Very high implementation and maintenance costs |

Overview Of BlackLine

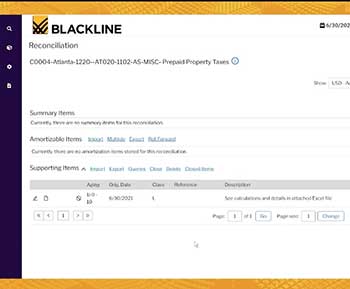

Founded in 2001, BlackLine provides cloud-based solutions for financial close management. Their platform standardizes, centralizes, and automates balance sheet reconciliations, journal entry management, and close task management.

Some key features and capabilities of BlackLine include:

- Account reconciliation – Simplify reconciliations by standardizing reports, managing by exception, and streamlining workflows. Provides full audit trail and compliance support.

- Transaction matching – Automatically match transactions across systems and data sources using predefined rules. Helps identify reconciliation differences.

- Task management – Create and assign closing tasks to team members and track their status throughout the period-end process.

- Reporting and analytics – Customizable dashboards provide real-time visibility into the close status. Identify bottlenecks, trends, and performance metrics.

- Integrations – Seamlessly integrates with hundreds of ERPs and financial systems through pre-built connectors and APIs.

- Security – SOC 1 Type 2 and SOC 2 Type 2 compliant. Robust access controls, encryption, data segregation, and change management.

BlackLine is a good fit for large enterprises with complex, decentralized finance operations. The extensive standardization and controls help improve accountability.

Overview Of Trintech

Trintech offers two main financial solutions: Cadency and Adra. Founded in 1998, Trintech aims to optimize the Record to Report process for large enterprises.

Key features of Trintech’s solutions include:

Cadency

- Reconciliation and close management – Cadency provides a centralized system to manage all aspects of balance sheet reconciliation and close processes. Workflows can be configured to match unique business requirements.

- Transaction matching – Smart matching algorithms learn behavior patterns to match transactions from different systems and data sources, ensuring accounting accuracy.

- Reporting and analytics – Real-time visibility into reconciliation and close status. Dashboards and role-based reporting can be customized.

- Audit-ready compliance – Maintains detailed audit trails and system-wide controls. Can generate reports showing internal controls by process.

Adra

- Automation for source-to-pay processes – Adra uses software robots, machine learning, and built-in intelligent workflows to automate routine finance processes like invoice receipt, PO matching, GL coding, and more.

- Process mining – Analyzes processes to identify bottlenecks, exceptions, and opportunities to implement automation.

- Analytics – Embedded analytics provide visibility into process performance, trends, and opportunities.

Trintech solutions are purpose-built to optimize large enterprise finance and accounting processes. The focus is on automation, visibility, and risk reduction.

Some key takeaways from this comparison:

- BlackLine has broader account reconciliation features while Trintech focuses just on balance sheet

- Trintech utilizes AI/ML for transaction matching versus rules-based engines

- Trintech places more emphasis on automation while BlackLine has stronger task management

- BlackLine offers more pre-built integrations while Trintech can handle more custom integration

- Both solutions are secure and compliant but BlackLine has more certifications

Also Read: Comparison Between Tiaa And Fidelity Retirement Plans.

Pros And Cons Of BlackLine

Pros:

- Comprehensive capabilities for managing all aspects of financial close

- Highly customizable to match complex business processes

- Robust controls and audit trails support compliance

- Reduces time spent on manual reconciliations

- Improves visibility with centralized data and reporting

- Integrates with many existing financial systems

- Secure platform built to support global enterprises

Cons:

- Implementation can be complex due to extensive configuration options

- Requires change management for adoption across the finance team

- Lacks advanced automation capabilities outside of reconciliation

- Higher learning curve for users to leverage full capabilities

- Potential for high total cost of ownership over time

Also watch this video!

Pros And Cons Of Trintech

Pros:

- Specialized solutions purpose-built for large enterprises

- Advanced automation and AI/ML streamlines record-to-report

- Provides workflow efficiencies and process visibility

- Enables scalability as business needs change

- Supports compliance and controls through auditable processes

- Analytics identify improvement opportunities

- Can integrate with all major ERP systems

Cons:

- Very complex implementation given deep process optimization

- Limited visibility beyond record-to-report processes

- Reconciliation capabilities are more narrow than BlackLine

- High total cost of ownership given integration requirements

- Requires dedicated resources to fully leverage capabilities

- Functions best for complex, mature processes

- Lacks support for as many regulations and frameworks

Key Differences And Similarities

While both platforms aim to streamline finance processes, there are some important distinctions:

- BlackLine offers a more unified platform while Trintech provides specialized point solutions

- Trintech places greater emphasis on automation over manual controls

- BlackLine has broader reconciliation features while Trintech focuses only on balance sheet

- Both platforms support compliance but BlackLine is certified for more regulations

- Both integrate with major ERPs but BlackLine has more pre-built connectors

- Trintech leverages AI/ML more extensively for matching transactions

- Solutions are complex to implement and optimize but provide long-term value

In summary, BlackLine offers a more user-friendly and customizable platform for comprehensive close management while Trintech provides purpose-built automation and analytics to optimize mature enterprise processes.

Also Read: Comparison Between VALIC And TIAA.

Frequently Asked Questions (FAQ)

BlackLine is a financial close solution that provides centralized reconciliation capabilities. Key features include standardized, automated account reconciliations, robust transaction matching, close task management, reporting, and integrations with ERP systems. BlackLine aims to reduce manual efforts while improving compliance and visibility in the record-to-report process.

Trintech offers Cadency and Adra financial solutions focused on optimizing and automating record-to-report processes for large enterprises. Cadency provides balance sheet reconciliation along with close task management and reporting. Adra leverages RPA and AI to automate routine finance transactions and processes. Together, these solutions aim to reduce risk, improve efficiency, and provide real-time visibility across the financial close cycle.

Trintech Cadency is a specialized financial solution designed to manage the entire balance sheet reconciliation and close process. Key features include automated reconciliation workflows, smart transaction matching, task tracking, compliance support, and embedded analytics for visibility into the close. Cadency brings controls, standardization, and automation to balance sheet reconciliation for large, complex enterprises.

Conclusion

BlackLine and Trintech both provide value by optimizing financial operations, but through different approaches. BlackLine enables centralized close management by standardizing reconciliation and adding controls, while Trintech drives efficiencies by deeply automating processes through AI and machine learning.

The right solution depends on your business needs. BlackLine is ideal for simplifying complex, decentralized accounting operations, while Trintech suits mature enterprises seeking to transform legacy processes.

Companies should consider their existing infrastructure, integration requirements, compliance needs, and desired balance of automation versus manual controls.

With the right financial solution in place, Finance teams can reduce risk, improve agility, and gain the real-time visibility needed to not just report on, but accelerate, financial performance.

Both BlackLine and Trintech offer platforms to unlock those benefits while meeting the evolving demands of the modern finance function.