Identity theft can happen to anyone, causing financial damage and major hassles. That’s why using an identity theft protection service is critical. Two popular options are AmEx CreditSecure and LifeLock.

This comprehensive guide compares AmEx CreditSecure vs LifeLock, analyzing their features, capabilities, pricing, and more. Read on for an in-depth look at how these identity theft protection services stack up.

A Brief Comparison Table

| Aspects | AmEx CreditSecure | LifeLock |

| Credit Bureaus Monitored | Experian, Equifax, TransUnion | Experian, Equifax, TransUnion |

| Alert Types | Report changes, inquiries, personal info | Credit apps, report changes, personal info |

| Identity Monitoring | Dark web scans, sex offender checks | Dark web scans, bank/credit account monitoring |

| Insurance Coverage | Up to $1 million theft expenses | Up to $1 million theft expenses + stolen funds |

| Resolution Help | Dedicated case manager | U.S. Certified Protection Experts |

| Monthly Cost | $9.99 | $9.99 and up |

| Cancellation Policy | Refund unused portion | Monthly fee non-refundable |

Overview of Identity Theft Protection

First, let’s review what identity theft protection services do. Their key features include:

- Credit monitoring – Tracking your credit reports for suspicious activity.

- Alerts – Getting notices for key changes to your credit file.

- Identity monitoring – Scanning dark web sites for your personal info.

- Fraud insurance – Reimbursing certain theft-related costs.

- Resolution assistance – Helping restore your identity and good credit.

- Additional protections – Varies, like social security number tracing.

Key Differences Between AmEx CreditSecure And LifeLock

Using an identity theft protection service adds an extra layer of security beyond checking your own credit. Now let’s compare AmEx CreditSecure and LifeLock head-to-head.

1. Credit Bureau Monitoring

A key differentiator is which credit bureau(s) each service monitors.

AmEx CreditSecure watches your reports at Experian, Equifax, and TransUnion. Monitoring all three major credit bureaus provides complete coverage.

LifeLock also monitors your credit report at Equifax, Experian, and TransUnion as part of its services.

So in terms of credit bureau coverage, both AmEx CreditSecure and LifeLock monitor the same three agencies and are equal in this regard.

2. Types of Credit Alerts

AmEx CreditSecure and LifeLock also provide alerts to notify you of important activity in your credit file. Here’s an overview of each of their alert options:

AmEx CreditSecure alerts for:

- Changes to your credit report like new accounts opened.

- Inquiries when someone requests your credit report.

- Changes to your personally identifiable information.

LifeLock alerts for:

- New credit applications made in your name.

- Changes in your credit utilization.

- Negative marks added to your credit file.

- Changes to your address and personally identifiable info.

The alert types provided are very similar between the two services. Both will notify you proactively of any unauthorized credit applications or report changes.

Also Read: Comparison Between LifeLock and LegalShield

3. Identity Monitoring and Protection

In addition to credit monitoring, AmEx CreditSecure and LifeLock provide identity monitoring to watch for misuse of your personal information.

Some key ways they monitor and protect your identity:

- Dark Web Monitoring – Both services scan dark web sites and alert you if personal info like your Social Security number is detected.

- Public Records Monitoring – They watch public records for suspicious activity associated with your identity.

- Address Changes – You’re alerted to any changes to your mailing address.

- Sex Offender Registry Checks – Both regularly check the registry and notify you of any matches.

- Social Security Trace – LifeLock performs SSN traces to detect other names associated with your number.

Overall, AmEx CreditSecure and LifeLock provide robust identity protection services by monitoring your personal information across credit bureaus, the dark web, public records, and more. Their capabilities are comparable for maximum identity security.

4. Fraud Insurance

A key benefit provided by identity theft protection services is insurance to cover certain costs if you become victim to fraud.

The fraud insurance provided includes:

AmEx CreditSecure

- Covers up to $1 million in theft expenses like legal fees or lost wages.

LifeLock

- Provides up to $1 million coverage for out-of-pocket theft costs.

- Reimburses up to $25,000 stolen funds per claim.

So in terms of maximum dollar amount, both services offer fraud insurance up to $1 million. LifeLock also covers a portion of stolen money, a nice added benefit.

5. Resolution Assistance

If you do suffer identity theft, having help to resolve it is priceless. Here are the assistance services included:

AmEx CreditSecure

- Dedicated Identity Theft Case Manager to help recover your identity.

- Assistance filling paperwork, making calls, filing police report.

LifeLock

- U.S.-based Certified Protection Experts provide personalized restoration help.

- Will place fraud alerts, contact agencies to dispute inaccurate information.

Both AmEx CreditSecure and LifeLock provide dedicated expert assistance to fully restore your credit and identity if compromised. This help can save hours of work resolving identity theft.

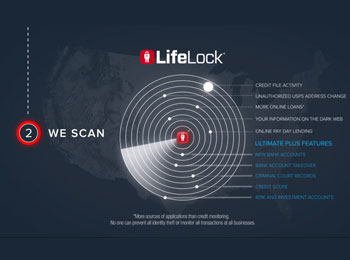

6. Additional Features

Some other features and capabilities of AmEx CreditSecure and LifeLock include:

- Credit Reports and Scores – Both provide on-demand access to your Equifax credit report and VantageScore credit score.

- Credit Lock – LifeLock includes the ability to quickly lock and unlock access to your credit reports when needed.

- Bank and Credit Card Alerts – LifeLock offers alerts when changes occur to your bank accounts and credit cards.

- Investment Account Activity Alerts – LifeLock monitors your investment accounts and notifies you of unauthorized activity.

- Driver’s License Monitoring – LifeLock watches for fraudulent use of your driver’s license information.

LifeLock comes with extra monitoring for bank accounts, investments, and license numbers that AmEx CreditSecure lacks. But the core credit protections are similar otherwise.

7. Cost Comparison

Let’s compare the pricing and costs of AmEx CreditSecure versus LifeLock:

| Service | Monthly Cost | Annual Cost |

| AmEx CreditSecure | $9.99 | $119.88 |

| LifeLock Standard | $9.99 | $119.88 |

| LifeLock Advantage | $19.99 | $239.88 |

| LifeLock Ultimate Plus | $29.99 | $359.88 |

Some key things to note:

- The entry-level monthly cost is the same at $9.99 for both providers.

- LifeLock offers higher level plans with added features like bank account alerts for more money.

- Annual pricing is also very similar between AmEx CreditSecure and LifeLock Standard.

- Can often find discounts on the annual pricing for each service.

For individuals, the entry pricing is virtually the same. LifeLock offers upgrades with more monitoring capabilities for increased cost.

Also watch this review video:

8. Customer Service Reputation

It’s important to consider the customer support and service reputation of any identity theft protection service you use:

- AmEx CreditSecure gets positive reviews for short wait times and helpful U.S-based customer service agents.

- LifeLock also is recognized for quality customer support and service recovery. Wait times can be longer occasionally.

Both companies provide reliable customer support channels like phone, email, and live chat. Overall, customer service ratings are strong for both providers.

9. Cancellation Policies

Before enrolling, understand each company’s cancellation policy:

- AmEx CreditSecure – Can cancel anytime with refund of unused portion if annual member.

- LifeLock – Cancellation available anytime but monthly fee is non-refundable.

AmEx CreditSecure offers a bit more flexibility for cancellation refunds compared to LifeLock. But both allow you to cancel your plan at any time.

Also Read: Comparison Between CreditSecure And Experian

Frequently Asked Questions (FAQs)

Here are answers to common questions people have when comparing AmEx CreditSecure and LifeLock:

Yes, AmEx CreditSecure gets strong reviews and provides robust credit monitoring, dark web scans, alerts, insurance, and resolution help. The $9.99 monthly plan is very reasonably priced for the protection received.

AmEx CreditSecure is an identity theft protection service from American Express that monitors your credit and personal information across major credit bureaus, public records, and the dark web. It alerts you of any suspicious activity in your name.

Experian offers robust identity theft victim assistance services as part of its credit monitoring plans. This includes a dedicated identity restoration agent and progress tracking until your identity is fully restored.

American Express relies primarily on data from TransUnion to make credit decisions for new applicants. However, they may review your credit files at Experian and Equifax as well.

Hopefully this detailed look at AmEx CreditSecure versus LifeLock was helpful. Be sure to consider your specific needs to select the right plan for you. With identity theft on the rise, having ongoing protection provides invaluable defense of your good credit and identity.

Final Thought

When deciding between AmEx CreditSecure and LifeLock, consider:

- Your budget – If you want extra monitoring like bank alerts, LifeLock provides upgrades.

- Needs beyond credit – LifeLock offers added investment, license, and bank account monitoring.

- Cancellation policy – AmEx CreditSecure refunds unused portion if annual member.

- Customer service needs – Both get strong reviews for support quality.

For the entry-level plans focused on core credit protection, AmEx CreditSecure and LifeLock are very similar in terms of capabilities and pricing. Review the additional monitoring features LifeLock offers on higher tiers if needed. Overall you can’t go wrong with either basic plan.