In the complex landscape of employment paperwork, two forms often cause confusion among employers and workers alike: the 1099 and the I-9. While both are essential documents in the hiring process, they serve very different purposes and have distinct implications for both businesses and individuals.

Let’s dive into the world of these forms and unravel the mysteries surrounding them.

Quick Comparison: 1099 Vs. I-9

| Feature | 1099 | I-9 |

| Purpose | Reports income for independent contractors | Verifies employment eligibility |

| Who uses it | Businesses hiring contractors | All employers hiring employees |

| When it’s used | Annually for tax reporting | At the time of hire |

| Information required | Contractor’s personal and tax info | Employee’s identity and work authorization |

| Legal implications | Tax classification | Immigration compliance |

| Penalties for non-compliance | Potential tax issues and fines | Hefty fines and legal consequences |

| Flexibility for workers | High | Low |

| Employer responsibilities | Minimal | Significant |

The 1099 Form: Freedom and Flexibility

Picture this: You’re a graphic designer working from your cozy home office, sipping coffee in your pajamas, and tackling projects for various clients. Sounds like the dream, right? Well, if this scenario resonates with you, chances are you’re familiar with the 1099 form.

What Exactly is a 1099?

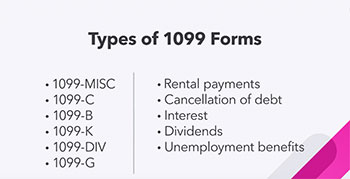

The 1099 form is a series of documents used to report various types of income other than wages, salaries, and tips (which are reported on a W-2 form). The most common type for independent contractors is the 1099-NEC (Non-Employee Compensation).

When a business pays an independent contractor $600 or more in a year, they’re required to issue a 1099-NEC to that contractor and file a copy with the IRS. It’s like a financial report card that tells the government, “Hey, we paid this person this much money for their services.”

Pros of Being a 1099 Contractor

- Flexibility: As a 1099 contractor, you’re your own boss. You decide when, where, and how you work. Want to take a midday yoga break? Go for it!

- Higher earning potential: Without the overhead of employee benefits, companies often pay contractors higher rates.

- Tax deductions: You can write off business expenses like your home office, equipment, and even that fancy coffee maker that fuels your late-night work sessions.

- Diverse experience: Working with multiple clients can broaden your skill set and expand your professional network.

- Entrepreneurial spirit: Being a contractor can be a stepping stone to starting your own business.

Cons of 1099 Status

- Lack of benefits: Say goodbye to employer-provided health insurance, retirement plans, and paid time off.

- Tax complexity: You’re responsible for paying self-employment taxes and making quarterly estimated tax payments. It’s like playing accountant four times a year!

- Income instability: Your workload and income can fluctuate, making budgeting a challenge.

- No unemployment benefits: If work dries up, you can’t claim unemployment.

- Less job security: Contracts can end abruptly, leaving you scrambling for new gigs.

Real-World Application

Let’s say you’re a web developer who just landed a gig with a cool startup. They’re not looking for a full-time employee but need your expertise for a six-month project. This is where the 1099 comes into play. You’ll complete the project as an independent contractor, and come tax time, you’ll receive a 1099-NEC showing how much you earned.

The I-9 Form: Ensuring Legal Employment

Now, let’s switch gears and imagine you’ve just landed your dream job at a cutting-edge tech company. You’re excited to start, but before you can dive into coding or strategizing, there’s some paperwork to tackle. Enter the I-9 form.

What is an I-9?

The I-9, or Employment Eligibility Verification form, is a document required for all employees (both citizens and noncitizens) hired in the United States. Its purpose? To verify the identity and employment authorization of individuals hired for employment in the U.S.

Think of it as the bouncer at the employment club, checking IDs to make sure everyone’s legally allowed to be there.

Pros of the I-9 Process

- Legal compliance: It ensures that companies are hiring individuals authorized to work in the U.S., keeping them on the right side of the law.

- Standardization: The form creates a uniform process for verifying employment eligibility across all industries and job types.

- Protection against discrimination: By requiring the same documentation from all employees, it helps prevent discrimination based on citizenship or national origin.

- Simplicity: The form is straightforward and doesn’t require extensive training to complete correctly.

- Fraud prevention: It helps reduce identity theft and unauthorized employment.

Cons of the I-9 Process

- Time-consuming: For large companies hiring many employees, the I-9 process can be a significant administrative burden.

- Potential for errors: Mistakes in completing the form can lead to penalties for employers.

- Document storage: Employers must retain I-9 forms for a certain period, which can be challenging for companies with high turnover.

- Privacy concerns: Collecting and storing sensitive personal information comes with data security responsibilities.

- Penalties for non-compliance: Fines for I-9 violations can be steep, potentially costing businesses thousands of dollars per violation.

Real-World Application

Remember that dream job at the tech company? Before you can start impressing everyone with your coding skills, you’ll need to complete the I-9 form. You’ll present documents proving your identity and work authorization (like a passport or a combination of driver’s license and social security card), and your employer will verify and record this information.

The Great Debate: Employee vs. Independent Contractor

Now that we’ve explored both forms, you might be wondering why companies choose one over the other. The decision between classifying workers as employees (I-9) or independent contractors (1099) isn’t just about paperwork—it has significant implications for both the business and the worker.

Why Employers Might Prefer 1099 Contractors

- Cost savings: Employers don’t have to pay for benefits, unemployment insurance, or the employer portion of payroll taxes for 1099 contractors.

- Flexibility: Companies can scale their workforce up or down based on project needs without the complexities of hiring and firing employees.

- Specialized skills: For short-term projects requiring specific expertise, hiring a contractor can be more efficient than training an employee.

- Reduced liability: Employers have less legal responsibility for contractors compared to employees.

- Simplified payroll: No need to withhold taxes or manage benefits for contractors.

Why Workers Might Prefer 1099 Status

- Independence: The freedom to choose projects, set your own hours, and work for multiple clients.

- Higher pay rates: Contractors often command higher hourly or project rates to offset the lack of benefits.

- Tax advantages: The ability to deduct business expenses can lead to significant tax savings.

- Career diversity: Working with various clients can provide a broader range of experience and networking opportunities.

- Work-life balance: The flexibility to design your own work schedule can lead to improved quality of life.

Also watch this!

The Flip Side: Advantages of Employee Status (I-9)

- Job security: Employees generally have more stable employment and income.

- Benefits package: Health insurance, retirement plans, and paid time off are standard for many full-time employees.

- Legal protections: Employees are covered by labor laws governing minimum wage, overtime, and workplace safety.

- Career advancement: Many companies offer training and promotion opportunities to their employees.

- Simplified taxes: Employers withhold taxes, making the tax filing process simpler for employees.

Navigating the Gray Areas

Sometimes, the line between employee and independent contractor can get blurry. Companies might try to classify workers as 1099 contractors to save money, even when the nature of the work suggests they should be employees. This misclassification can lead to legal trouble and hefty fines.

Here are some factors that determine whether someone should be a 1099 contractor or an employee:

- Control: Does the company control or have the right to control what the worker does and how they do their job?

- Financial aspects: Are the business aspects of the worker’s job controlled by the company? (These include things like how the worker is paid, whether expenses are reimbursed, who provides tools/supplies, etc.)

- Type of relationship: Are there written contracts or employee-type benefits (i.e., pension plan, insurance, vacation pay, etc.)? Will the relationship continue and is the work performed a key aspect of the business?

If you’re unsure about your classification, it’s worth consulting with a legal or tax professional. Remember, it’s not just about what’s written on paper—it’s about the actual nature of the working relationship.

The Impact on Business Operations

The choice between 1099 contractors and employees (I-9) can significantly affect how a business operates. Let’s break it down:

Managing 1099 Contractors

Working with 1099 contractors often means:

- Project-based work: Tasks are typically defined by specific projects or outcomes rather than ongoing duties.

- Limited training: Contractors are expected to bring their expertise to the table, requiring less onboarding and training.

- Minimal oversight: While quality control is important, contractors generally have more autonomy in how they complete their work.

- Flexible workforce: Companies can quickly scale up or down based on project needs without the complexities of hiring and firing employees.

- Diverse skill sets: Businesses can tap into specialized skills for specific projects without maintaining a full-time expert on staff.

Managing Employees (I-9)

On the flip side, working with employees typically involves:

- Ongoing responsibilities: Employees often have continuing duties and a more defined role within the company structure.

- Comprehensive training: Companies invest in developing their employees’ skills and knowledge.

- Direct supervision: Managers have more control over when and how work is completed.

- Team building: Employees are part of the company culture and are often involved in team-building activities and company events.

- Long-term planning: Businesses can develop talent over time and plan for future growth with a stable workforce.

Compliance and Legal Considerations

Navigating the world of 1099s and I-9s isn’t just about filling out forms—it’s about staying on the right side of the law. Let’s look at some key compliance issues:

1099 Compliance

- Proper classification: Ensuring workers meet the IRS criteria for independent contractors is crucial. Misclassification can result in back taxes, penalties, and legal issues.

- Timely filing: 1099 forms must be provided to contractors and filed with the IRS by specific deadlines.

- Recordkeeping: Maintaining accurate records of payments and contracts is essential for tax purposes and potential audits.

- State laws: Some states have stricter rules about who can be classified as an independent contractor.

I-9 Compliance

- Timely completion: I-9 forms must be completed within three business days of an employee’s start date.

- Document verification: Employers must physically examine the documents presented by employees to establish identity and work authorization.

- Retention: I-9 forms must be kept for three years after the date of hire or one year after the date of termination, whichever is later.

- Non-discrimination: Employers cannot specify which documents an employee must present for verification.

- Re-verification: For employees with temporary work authorization, employers must re-verify their eligibility before it expires.

The Future of Work: Evolving Trends

As we look ahead, the landscape of work continues to evolve, blurring the lines between traditional employment and independent contracting. Here are some trends to watch:

- Gig economy growth: The rise of platforms connecting freelancers with clients is changing how we think about work.

- Remote work revolution: The shift towards remote work may lead to more flexible employment arrangements.

- Hybrid models: Some companies are exploring ways to offer the benefits of employment with the flexibility of contracting.

- Legislative changes: Lawmakers are grappling with how to adapt labor laws to the changing nature of work.

- Technology and compliance: New tools are emerging to help businesses manage the complexities of worker classification and compliance.

FAQs

While both forms are related to independent contractors, they serve different purposes:

1099 form: This is issued by a company to report payments made to a contractor. It’s sent to both the contractor and the IRS.

W-9 form: This is completed by the contractor and provided to the company. It includes the contractor’s tax information (like their Social Security Number or Employer Identification Number) that the company needs to issue a 1099.

In essence, the W-9 is the precursor to the 1099. The contractor fills out the W-9 when starting work, and the company uses that information to create the 1099 at the end of the tax year.

No, the I-9 form is not required for 1099 contractors. The I-9 is specifically for employees (those who receive a W-2), not for independent contractors. Here’s why:

Purpose: The I-9 verifies an individual’s eligibility to work in the United States as an employee.

Employment status: 1099 contractors are not considered employees of the company they’re working for.

Legal responsibility: Companies are not responsible for verifying the work authorization of their independent contractors.

However, it’s important to note that while companies don’t need to complete an I-9 for 1099 contractors, they should still ensure they’re not knowingly engaging contractors who are unauthorized to work in the U.S.

The I-9 and W-9 forms serve very different purposes:

I-9 (Employment Eligibility Verification): Used for employees (W-2 workers)

Verifies identity and employment authorization

Required for all new hires, regardless of citizenship

Completed by both the employee and the employer

W-9 (Request for Taxpayer Identification Number and Certification): Used for independent contractors (1099 workers)

Provides the contractor’s tax information to the hiring company

Used by the company to prepare 1099 forms

Completed only by the contractor

In short, the I-9 is about work eligibility for employees, while the W-9 is about tax information for contractors.

Employers often prefer using 1099 contractors for several reasons:

1. Cost savings: They don’t have to pay for benefits, unemployment insurance, or the employer portion of payroll taxes.

2. Flexibility: It’s easier to scale the workforce up or down based on business needs.

3. Reduced liability: Employers have less legal responsibility for contractors than for employees.

4. Specialized skills: Contractors often bring specific expertise for short-term projects.

5. Simplified administration: No need to withhold taxes or manage benefits.

6. Lower overhead: Contractors often provide their own equipment and workspace.

However, it’s crucial for employers to ensure they’re correctly classifying workers. Misclassifying employees as contractors to save money can lead to serious legal and financial consequences. The decision should be based on the nature of the work relationship, not just cost considerations.

Also Read: 1040.com Vs. TurboTax: Better Tax Preparation Software

Conclusion: Navigating the 1099 Vs. I-9 Landscape

In the end, both the 1099 and I-9 forms play crucial roles in the modern workforce. The 1099 represents the flexibility and entrepreneurial spirit of independent contracting, while the I-9 ensures legal compliance and protects workers’ rights in traditional employment settings.

Whether you’re a business owner deciding how to classify your workers, or an individual choosing between employment and freelancing, understanding these forms is key to making informed decisions. Remember, there’s no one-size-fits-all solution—the best choice depends on your specific circumstances, goals, and legal requirements.

As the world of work continues to evolve, staying informed about these classifications and their implications will be crucial for navigating the changing landscape of employment. Whether you’re Team 1099 or Team I-9, knowledge is power in the complex world of work and taxes.